Saturday, January 31, 2009

Chilliwack Realtors in the Poorhouse

The upper Fraser Valley real estate market is being crushed under the burden of 24 months of inventory with exceptionally low sales volumes coupled with sky high inventory. There are over 280 realtors in the board's area and there were only 67 property sales in the month of December which by my elementary math means that there were over 200 realtors going hungry during the month of December. Perhaps we should start a collection so they are able to make their Lexus payments.

Total MLS® sales activity increased in December 2008, while residential sales activity declined in the area served by the Chilliwack and District Real Estate Board, according to statistics released by the Board. The Board's MLS® system recorded $23,492,025 worth of sales this December. That's a nine per cent increase from the total posted this past November, and a 49 per cent drop from the total in December 2007.

A total of 67 properties traded hands through the Board's MLS® system in December 2008, which is 12 per cent lower than the total from November and 55 per cent less than in December 2007.

"It’s no surprise that sales slow down during the final quarter of the year," said Board President Trude Kafka. "This trend is not unique to our region. However, we did see an increase in total MLS® sales – despite a monthly decline in total MLS® property listings. Property values continue to increase in our region. Hopefully these trends will continue well into 2009."

The total value of home sales recorded through the Chilliwack and District Real Estate Board's MLS® system this December was $18,999,700 – which is nine per cent lower than the total from November 2008, and 52 per cent below the amount posted in December 2007.

In all, 63 homes were sold through the Board's MLS® system this December. That's 15 per cent lower than in November, and 49 per cent less than last December.

The average price of homes sold through the Board's MLS® system this December was $301,583, which is seven per cent above the average from November 2008 and five per cent lower than the average from December 2007. The Board cautions that the average residential price is a useful figure only for establishing trends and comparisons over a period of time. It does not indicate an actual price for a home due to the wide selection of housing available in the area.

The Chilliwack and District Real Estate Board handled a total of 2,224 MLS® sales in 2008, a sharp decline of 37.2 per cent compared to the total number of MLS® properties sold in 2007. All of the 12 real estate Boards and Association in British Columbia processed a total of 74,484 properties through their local MLS® systems, representing a 33.4 per cent decline from the total properties sold in 2007. The MLS® properties sold through the Chilliwack and District Real Estate Board had a total value of $699.4 million, representing a 35.4 per cent decrease compared to 2007. Provincially, the value of all MLS® properties sold in 2008 had a total value of $33 billion, a 30.9 per cent decline from 2007 levels.

2,036 of the MLS® properties sold locally in 2008 were residential, down 37.7 per cent from the number of residential MLS® properties sold in 2007. Provincially, the number of residential MLS® properties sold declined 33 per cent compared to 2007. Residential properties sold locally in 2008 had a total value of $643.8 million, sinking 34.2 per cent compared to 2007. On the provincial level, total residential MLS® sales in British Columbia in 2008 had a value of $33.1 billion, a 30.6 decrease from record-setting 2007 levels.

There were 5,482 new listings processed through the MLS® system of the Chilliwack and District Real Estate Board in 2008, an 11.4 per cent increase compared to the number of new listings processed in 2007. Provincially, the number of new residential listings in 2008 increased 12.1 per cent compared to 2007 to 176,762 properties.

A total of 181 new residential listings were added to the Board's MLS® system this December, an 18 cent increase from December 2007. As the month came to an end, there were 1,524 active residential listings on the Board's MLS® system.

The Chilliwack and District Real Estate Board is an association of 283 REALTORS® that provides services to and sets standards for members. The Chilliwack and District Real Estate Board serves Chilliwack, Agassiz, Hope, Boston Bar and Harrison.

Thursday, January 29, 2009

Demographia (again)

Oh really.

There are some obvious flaws in the study as it pertains to affordability on which I will now elaborate.

Owning != Living

The study shows how house prices and affordability are correlated to the degree of land restriction. Yet it is not just housing affordability that should be looked at for a city's overall affordability. While many choose to own property, there are alternatives, namely renting. For the survey to truly gauge a city's affordability in terms of its population's ability to afford to live (not necessarily own), we must also include the rental option. Property values are subject to swings due to speculation and in themselves are a poor measure if rents are not increasing as well.

The survey does argue that land restriction can more easily lead to speculation. Maybe. Though some cities were notably absent from their data set (more below).

Affordable in the Rust Belt

p. 20 of the report has the evil red "unaffordable" cities lined up on the same chart as the haloed green "affordable" cities. Let's look at the green cities a bit more closely. Notables are: Indianapolis, Detroit, Cleveland, Cincinnati, and Pittsburgh. Is it too obvious to say that these cities have flat to decreasing populations and high unemployment? No wonder their land restrictions are so loose. The local authorities need to pull out all the stops to PREVENT people from leaving!

Cart and Horse

A question to ask, again a pretty obvious one, is whether restrictive land use is causally linked to affordability. The survey certainly shows correlation but seems to gloss over causation.

English Only

As hinted above, the survey seems to leave out other first world cities and concentrates on only English speaking cities. Why not include Paris, Stockholm, and Frankfurt? Could it be that these cities have restrictive land use policies but more favourable affordability?

Restriction? What Restriction?

Check out mohican's last post on CMHC construction data. If Vancouver has "restrictive" land use policies, it seems there may be a few loopholes, given the MASSIVE housing supply coming online. How could a city with such tight reins on land use produce such oversupply? It blows the mind.

Overall I am surprised the survey is given so much press. Their exclusion of data is suspect, their conclusions not well backed by logic, and their basic premises around what "affordability" really is are not discussed in their analysis. Every year there is a debate on local blogs about this survey. Sure, Vancouver is severely unaffordable. We all know that and this survey confirms the obvious. (Another annoyance is the types of data used for certain markets vary so the affordability number for Vancouver is not apples-apples with other cities) But this survey is not really about displaying the data and I'll stick to a more holistic combination of Case-Shiller, rents, and incomes, without the suspect analysis, thanks very much.

Monday, January 26, 2009

December 2008 CMHC Data - Vancouver CMA

A truly amazing statistic contained in the December data is the number of completed but unsold units. The number of unabsorbed units has risen from 1292 in December 2007 to 2363 in December 2008. Obviously, developers are having trouble selling the units that are now vacant and available. This is why we are seeing these creative marketing tactics and price cuts.

Friday, January 23, 2009

Developer Turns Condos into Rentals

"In many cities, banks have significantly scaled back loans to condominium builders. Some have demanded that developers sell half or more of the units in a building before even beginning construction.

In hopes of salvaging something from their costly plans, hundreds of developers like Franco are looking to the strong market for apartments, planning to rent their units for at least a couple of years while waiting for today's condo surplus to shrink.

After six weeks of failing to lure more than a couple dozen buyers, Franco and his partner, Jeff Blum, joined the builders of nearly 6,000 condominium units in the Washington metropolitan area who have decided in the last three months to recast their projects as rental apartment buildings."

Read the whole thing. Like a book we've already read, today we hear this:

"In the face of sales that have ground to a halt, Wall Financial Corp. has decided to scrap its 414-unit Wall Centre False Creek condominium project in favour of building rental apartments on the site, company principal Peter Wall said in an interview.

In its last quarterly financial results, Wall Financial said it had sold almost 30 per cent of the Wall Centre Creek's units, 120 in all, but that sales had come “to almost a complete stop” during the quarter."

I see. What an innovative concept! Vancouver hasn't seen any substantive purpose-built rentals for years now so sounds like a winner; a real contrarian move. Surprised nobody else has thought of that. I would love to see how Mr. Wall pitches this idea to his financial backers, or is he using his own money?

Thursday, January 22, 2009

Denial - It's Not a River in Egypt

The Nile River is a long river, in fact, it is generallly regarded as the longest in the world. It represents a very large drainage basin, covering much of North Africa.

Likewise, DE-NIAL can be the drainage basin of your finances if you aren't careful. According to Wikipedia, denial is a defense mechanism in which a person is faced with a fact that is too uncomfortable to accept and rejects it instead, insisting that it is not true despite what may be overwhelming evidence. The subject may deny the reality of the unpleasant fact altogether (simple denial), admit the fact but deny its seriousness (minimisation) or admit both the fact and seriousness but deny responsibility (transference).

So today, many of the people you see around you are in denial about the reality of the Canadian real estate market. They are so uncorfortable with the fact that prices have fallen and are falling further that they outright deny the fact. Sometimes they admit that prices have fallen but minimize the impact that it will have on Canadians or themselves. Sometimes they just admit that prices are falling and that it will have a big impact but walk away from their 3 spec condos.

Yes folks were are in the denial stage. Next stop 'fear' - - I'm scared.

Good luck!

Tuesday, January 20, 2009

Bank of Canada cuts lending rate to record low of 1%

Saturday, January 17, 2009

B-b-b-b-baby, You Just Ain't Seen Nothin' Yet

Many prognosticators, extrapolators, eternal optimists, and kool-aid drinkers have concluded that the worst is behind us in terms of price drops and I will now tell you why that is far from being the case.

Quite simply, there is TOO MUCH DAMN SUPPLY for the level of demand we had last year nevermind the level of demand we see today in the midst of a full blown credit contraction and recession. Shockingly ;-) people don't really want to commit themselves to a 35 year payment schedule, with payments double their current rent, when their job prospects are weak or at risk.

For those of you who are now planning on waiting until 'the market recovers' to sell your home, you may be waiting many, many years. The real estate market is not like the stock market, where crashes and recoveries can happen over a period of weeks or months. The real estate market takes years to exhibit the same market movement so get honest with yourself and don't let your realtor give you some mumbo-jumbo about a spring market rebound because the facts just don't bear that point of view out.

So the question becomes - When will we see more demand and less supply - ie. a recovery?

The answer of when a recovery will come is not complicated and actually we can make an educated estimate of when supply and demand should come back into balance. When supply and demand come back into balance, the worst of the price drops should be over and we can reasonably expect a 'recovery' of sorts, or at least no more big price drops! This doesn't necessarily mean a return to the rapid price appreciation of the bubble years nor does it mean that we will attain the lofts heights of 2007 pricing again soon, in fact, it is likely that we will not see spring 2008 peak pricing for at least a decade and if we adjust for inflation, my children may never see that day.

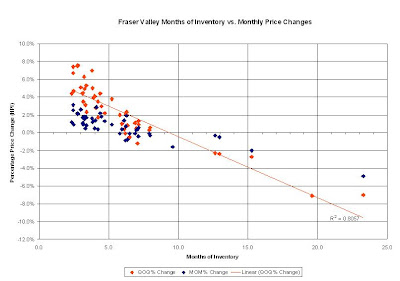

In the current supply / demand situation, with well over 15 months of inventory in every major BC real estate market, we will see price drops in the order of -2% or more per month. This has been true of the past year.

For argument's sake, let's just say that the demand in the current real estate market does not deteriorate further and again let's imagine the looming supply of new homes under construction that will complete in the next 18 months is reasonably around 20,000 units. With current existing home inventories in the Greater Vancouver area and the growth in listings that is typical for the first half of the year we should see approximately 25,000 units for sale by the time May or June rolls around. Sales will likely be in the 1200 to 1500 per month range giving us a months of inventory metric well over 15 months again.

This means that 2009 will not be a positive year for prices in the local real estate market. In fact, assuming the trend shown in the chart above holds true this year, we should see continued price declines of 2% or more per month. If there is a further influx of inventory via new home completions or existing homes coming onto the market, or a further deterioration of demand, things could be much, much worse.

In regards to prices, here are my best case, reasonable case, and worst case scenarios for 2009:

Best Case - average of 2% declines per month, inventory does not exceed 25,000 units, sales hold up at 2008 levels, benchmark price finishes the year above $525,000.

Reasonable Case - average of 3% declines per month, inventory does not exceed 30,000 units, sales fall modestly from 2008, benchmark prices finishes the year above $475,000.

Worst Case - average of 4% declines per month, inventory exceeds 30,000 units, sales fall dramatically from 2008, benchmark prices barely finish the year over $400,000.

If these predictions seem alarming, then you haven't had a good look at the facts yet. There will be no recovery until 2011 at the earliest. For those of you looking to sell a home this year, get real, and drop your price to be the lowest in your neighbourhood, otherwise it isn't going to sell. For those of you looking to purchase, wait, or drive a very hard bargain, and be prepared for further price drops. If you are a developer, cut prices hard, 30% or more, and finish up your projects fast. If you are a city that happens to have a huge development full of unsold units on your hands, get rid of them, FAST.

Real estate prices will be 20-40% lower than now only 12 months from now so move fast if you're selling and move slow if you're buying.

Good luck because You Ain't Seen Nothin' Yet.

Wednesday, January 14, 2009

Big Developer Blinks and Offers Sizeable Discounts

From CBC News:

A Vancouver real estate developer is making an unprecedented move to offer a liquidation sale of $350 million worth of its condominiums throughout the Lower Mainland.

The marketing strategy by Onni Group of Companies is aimed at selling off hundreds of condos in its inventory.

About 375 unsold condominiums in cities such as Richmond and New Westminster will be offered at 20 to 40 per cent off, a real estate insider told CBC News.

It is not known whether the big discounts are based on prices when the condos were completed or current market values. Onni was to hold a media event Thursday to announce details.

Onni's marketing tool might nudge some reluctant homebuyers off the fence, said Tim Silk, an assistant professor at the University of British Columbia's business school.

"If you see the units being priced below comparable units, then you might see people jump in," Silk said Wednesday. "But there's still that hesitation of, 'Have we reached bottom?' "

Home prices in the Vancouver real estate market dropped almost 11 per cent between December 2007 and the end of 2008, according to a special price index updated earlier this month by the Real Estate Board of Greater Vancouver.

And the number of homes sold in 2008 fell more than 35 per cent from 2007 sales of more than 38,000 homes.

Good luck Onni. Onni blinks first in the 2009 showdown. This is likely the right move as they get the most free press and don't have to hang on to as much inventory through the year.

Wake up to the rest of the developers - drop your prices now and you may get to survive this cycle and live another day.

Monday, January 12, 2009

Calamity on the Creek

What I found striking in reading Bula and other journalists is that what they consider the 'worst case scenario' for the condo market is actually *still* pretty much in the lands of hopes and dreams. The scenarios they seem to be running are things like 20% off pricing, or waiting 2 or 3 years until the market 'comes back.' What I find striking is how people that are intelligent and presumably well-informed seem to be unable to clearly see where this market is going.

Here's one thing that Frances said:

Being a fence-sitter, as my loving critics like to call me, I find myself as unconvinced by those who say (with considerable glee) that the housing market as we knew it will never EVER return to anything near what it was as by those who thought condos would keep selling like cheap underwear at Wal-Mart.

What does she mean by 'what it was'? Yes, people will continue to buy and sell condos. At some point, sales will rebound. They will in fact again sell like underwear at Walmart. But at what price? Does she mean 2007 pricing? Of course, in nominal terms this will happen at some point, but not any time soon.

Here's how I see it. No, prices will not fall forever and they won't fall to zero. Instead, with speculators out of the market, the bottom for prices will be set by cash-flow investors and/or rent vs. buy residents. If these people need, say, a 7% gross yield on investment, then in order to get $1000/sf (which is the number bandied around as break-even for the Olympic Village), we need to see rents at (1000*.07/12)=$5.83/sf per month. This means that a 1000sf condo rents for $5830. Now, the Oly Village might be nice and ultraluxury and all that, but I think it will be awhile until incomes rise to allow $5.83/sf.

Now, maybe one of these assumptions is wrong. Maybe speculators will return to the market and blow a new bubble. Could happen, but I doubt it will happen in the next few years. Maybe investors don't need 7% gross. I don't know. But I'm pretty sure that, while not forever, it will be a l o n g time before rents justify $1000/sf.

Look. It's as simple as this graph. Forget the politics. Forget the legal mumbo jumbo. Forget Bob Rennie's new age condo spin. What people are apparently still not getting is that a 'return to normal' does not mean returning to 2007. It was 2003-2007 that is the anomaly; not 2008-09.

[note: updated graph to Q3 2008. Data here.]

UPDATE: Here is Gary Mason in today's G&M. My impression of Mason is that he is a hard-nosed, cynical journalist. Yet he is still caught in the hype:

The city may be able to take the long view and hold on to unsold condominiums until the economy and real-estate market turn around and the value of the units returns to something resembling what they were expected to be about now.See, his worst case scenario is that the market recovers to 2007 wish prices (not actual prices, but the 2007 presale wish prices) in 6 or 7 years. Not. Going. To. Happen.Then again, that might not be for another six or seven years. No one knows.

Sunday, January 11, 2009

The Ownership Premium

The "ownership premium", sometimes called the "control premium", is a premium that a potential buyer will pay for the right of owning (and "controlling") a property compared to renting. Here is an example thought process of how the premium concept works, from a buyer's perspective:

jesse is renting a condominium for $1200 per month but is on a month-to-month lease. With a wife and young child, jesse does not want the uncertainty of renting month-to-month and his wife wants to customize the suite, something not always possible when renting. jesse looks at the condo for sale next door. If he were to buy it at market rate, the total costs of doing so far exceed that of continuing to rent. After factoring in all expected costs and trade-offs, jesse decides he is willing and able to pay a monetary premium to buy. But – and here's the thing – he doesn't have to.

The alternate view of the ownership premium looks not at individual circumstances but at the overall market comprised of owner-occupiers and investors competing over the same product. Here, for simplicity, we can look at condominiums that have a healthy mix of both owner-occupiers and investors. If owner-occupiers will pay a market premium to own, the investor must compete by also paying the same premium. This has the effect of reducing the investor's yield and instead must rely on capital gains to compensate for the poor yield.

In speculative bubbles, low rental yields go virtually unnoticed because everybody is "making money" on capital appreciation. Investors can compete head-to-head with owner-occupiers because rental yield is dwarfed by capital appreciation. The "ownership premium" train of thought becomes justified, even amongst many investors who justify it as a premium for scarcity and control of how the property is used. During bubbles, the premium continually increases.

However, when a bubble deflates, total return is not about capital appreciation but net income from rents. At this point the investor will require higher rents or lower prices to make the investment worthwhile. Housing markets around the world are starting to revert to where cash flows make sense again and this means lower prices. Rising rents are next to impossible when there is an oversupply of dwellings and wages are flat to falling with rising unemployment. The ownership premium, for investors, is once again meaningless.

This does not mean that the ownership premium for owner-occupiers is a fallacy. It exists and is real. In addition, for many others, the mobility and lower responsibility offered by renting means their personal premiums are negative. The point is that it doesn't matter. When a significant portion of a market is focused on monetary returns ex intangible benefits – i.e. investors –they will eventually and invariably set the price. It also doesn't mean anyone is necessarily wrong for paying a premium but ones doing so should not use it to justify high prices and instead realize they made an investment with a lower monetary return.

Edit: the "ownership premium", as described here, is in its essence describing one's personal preference to own or rent a property -- the "intangibles" of ownership. It is not to do with more tangible premiums related to speculation of future price gains or expected increased utility by densification. The point is the intangibles of ownership do not in themselves justify higher prices.

Saturday, January 10, 2009

New Home Prices Falling

New home prices fell in November for the second consecutive month-to-month decrease, Statistics Canada said Monday.

The average price on a new house declined 0.3%, the federal agency said, as demand continued to cool across the national real estate market in the fall.

The dip continues the first reverse in home prices in more than a decade, following the 0.4% decline experienced in October.

Yet the results varied from region to region, with some markets still witnessing considerable price increases.

St. John's recorded the largest annualized gain, with the value of a new home up more than 25% from 2007, a clip that narrowly outpaced Regina. The monthly increase in St. John's was 3.4%.

In a sign that Saskatchewan is beginning to feel the bite of a recession it has largely avoided so far, home prices were flat in Regina in November while in Saskatoon prices continued to come down.

New home prices were down 0.5% in Saskatoon "confirming a trend of deceleration in this city," Statscan said. "Builders continued to report difficult market conditions."

The drops continued further west. New home prices in Edmonton recorded a 12-month plunge of 7.9% - largest monthly decline since May 1985. Prices dipped 2.5% in Calgary. On a monthly basis, prices fell 0.3% in Edmonton and 1.1% in Calgary between October and November.

On the West Coast, builders cut new home prices in Vancouver by 1.7% in November, a trend continued in Victoria, Statscan said.

Markets in Eastern Canada, which have shown more stable supply-demand conditions, continued to rise, Statscan said. Compared with November 2007, contractors' selling prices were 4.3% higher in Ottawa and 2.0% higher in Toronto. In Québec, the 12-month growth rate was 5.4%, while in Montréal, prices increased 4.6%, the agency said.

No market east of Saskatchewan experienced a month-to-month decline in new home prices.

TD Economics: R.I.P. residential construction boom, 2002-2008.

Is 175,000 units or so the new norm or level we should expect going forward? Not likely. In a recessionary context, we think housing starts in Canada will undershoot that benchmark for a while. On a national scale, our forecast calls for a bottom in housing starts near 140,000 units in the fourth quarter of this year – hence another 20% lower than the last recorded levels. On an annual average basis, starts will likely average around 150,000 units in both 2009 and 2010. From a regional perspective, the housing starts downtrend, while broadly-based, has been, and will continue to be, most severe in B.C. and Alberta. No province is immune from this, however, and we expect every province to record double-digit percentage dips in housing starts for 2009 when compared to the still lofty levels of 2008.

The employment data also line up well in confirming this long-awaited, and just as long in coming, downturn. During the first three quarters of 2008, the construction industry (as defined in the Labour Force Survey (LFS), which includes non-residential construction) was creating jobs at an average monthly pace of 11,200. A sharp U-turn occurred in the fourth quarter of 2008 to close out the year on a sour note, with jobs being shed at an average monthly pace of 15,300. Back-checking with the establishment payroll survey helps confirm that the residential segment, rather that the non-residential or engineering segments of construction, is indeed most likely responsible for the construction employment losses showing up in the LFS data. All said, it certainly seems as though an important chapter in which the residential construction industry was contributing to Canadian growth and employment in an outsized fashion, has come to an end. Lagging slightly behind the rest of the economy, residential construction has crossed over into the recessionary chapter, and looks unlikely to come out of it before 2010.

Pascal Gauthier, Economist, 416-944-5730

Friday, January 9, 2009

Vancouver Housing Starts - December 2008

Thursday, January 8, 2009

Calgary Real Estate Market Under Pressure in 2008

The Teranet - National Bank House Price Index data also bears these price decline numbers out.

Tuesday, January 6, 2009

Greater Vancouver Prices Decline Dramatically for 7 Months in a Row

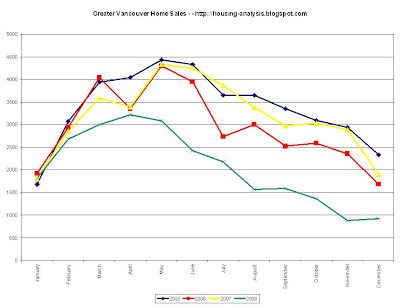

2008 certainly was an interesting year for real estate market observers in Vancouver. For nearly 2 years the local market bucked the declining price trends seen in the US and elsewhere. Pundits had proclaimed that the local market was immune or insulated from the turmoil elsewhere. Oh how wrong they were. Benchmark detached home prices in the Greater Vancouver area are now at the same level as they were in June 2006.

This story is really all about supply and demand. There is lots of supply with even more coming and very little demand. Active listings are significantly above previous year's levels so the supply side is not helping those who want higher prices.

One may look to the demand side of the equation for some hope for some price appreciation but monthly sales are at half the level they were during the boom years with no quick fixes in sight.

Consequently, it would take a very long time, 16.4 months to be exact, for the current level of inventory to be sold off at the current rate of sales. This essentially means that the market is completely saturated with product and the only sales to be seen are the deep discounts.

The correlation between months of inventory and price changes is extremely tight with any MOI level above 7 MOI indicating further price declines. At the current level of more than double that, I do not expect rising prices anytime soon.

As mentioned previously, prices are now back at mid-2006 levels and the retreat has only begun. I fully expect inventory to swell in the new year and sales to continue at a lacklustre pace which will put continued and significant negative price pressure on sellers for the next while.

Fraser Valley Real Estate Now at 7 Months of Price Declines

Sales were extremely low at well under half the monthly volume of the heyday years of not so long ago. 508 sales is very little. It amuses me how the Real Estate Board highlighted the fact that December sales were higher than November sales. Yes, I can do math too Kelvin - - 508 is bigger than 507. How this is relevant I do not know.

Months of inventory remains highly elevated and is an important indicator of a distressed real estate market at these levels. Look for further price declines throughout 2009.

The sell list ratio is extremely low which indicates that very few real estate wanna-be-sellers are turning into real estate sellers. Consequently, price pressure is highly negative as those who must sell are forced to lower prices to draw in potential buyers.

Median Prices are continuing to retreat.

The correlation of the supply/demand metric and price changes is continuing to be remarkably resilient as we have moved to the other end of the see saw. It is as if somebody flipped a switch in May 2008 and buyers stopped showing up.

Benchmark home prices, which are the best indicator of the actual change in property values have declined nearly 10% now and values are at the September 2006 level.

Monday, January 5, 2009

Fraser Valley Real Estate Prices Continue Falling

2008 YEAR OF CHANGE AND OPPORTUNITY FOR FRASER VALLEY REAL ESTATE MARKET

(Surrey, BC) – December’s sales statistics from the Fraser Valley Real Estate Board’s Multiple Listing Service (MLS®) reflect thereal estate story of 2008: change. Sales of all property types for the year declined 30 per cent in the Fraser Valley; however, sales for the month were down almost 50 per cent compared to December 2007 – punctuating how the move to a buyers’ real estate market, similar to changes overall in the economy, took place in the second half of 2008.

Residential benchmark prices, the value of a ‘typical’ Fraser Valley detached home as determined by the MLSLink® Housing Price Index (HPI)*, decreased 6.5 per cent this year, with December showing the seventh consecutive monthly decline. The benchmark price was $496,391 in December 2007 compared to $464,189 last month. That price has decreased 9.7 per cent since May 2008 when it was $513,798.

The HPI benchmark price of Fraser Valley townhouses decreased by 8 per cent in one year, going from $322,295 in December 2007 to $296,296 in December 2008, while the benchmark price of apartments decreased from $247,822 to $237,786, a - 4 per cent change in one year.

“Prices could not have continued to increase at the pace they were over the past six years,” says Kelvin Neufeld, President of the Fraser Valley Real Estate Board. “The change in the real estate cycle has created tremendous opportunities for consumers right now and they’re starting to recognize that fact.

“Fraser Valley REALTORS® were already seeing home sales in early December surpass those of November, signaling that buyers recognize the current advantages of price reductions combined with historically low interest rates and inventory at record levels.” Fraser Valley’s total sales volume in 2008 was 13,194 compared to 18,862 in 2007. Over the course of the year, Fraser Valley REALTORS ® listed 35,651 properties, an 8 per cent increase compared to 2007’s 32,953 listings. The number of active listings at year’s end finished at 9,960, 50 per cent higher compared to 6,646 active listings in December 2007.

Year-to-date average prices of single-family detached homes in the Fraser Valley increased 3.4 per cent going from $520,317 in December 2007 to $537,960 in December 2008. In one year, the average price of a townhouse increased 3.6 per cent going from $322,578 in 2007 to $334,259 in 2008. The average apartment price increased 5.8 per cent, reaching $229,488 in 2008 compared to $216,990 in 2007.

Real Estate Prices fall again in December 2008

2008 brought improved housing affordability to Greater Vancouver

VANCOUVER, B.C. – January 5, 2009 – The record-breaking real estate market cycle in Greater Vancouver, longer than normal at seven consecutive years, ended in 2008 amidst global economic challenges. The change brought relief from rising prices that saw benchmark prices escalate from $357,770 for a single family detached home in December 2001 to $648,421 by December 2008.

The Real Estate Board of Greater Vancouver (REBGV) reports that sales of detached, attached and apartment properties decreased 35.3 per cent in 2008 to 24,626 sales compared to 38,050 sales in 2007. Property listings for the year increased 13.9 per cent to 62,561 compared to 2007 when 54,945 new properties were listed. “Trends in the latter half of 2008 showed a consistent month-over-month decrease in residential housing prices, a departure from the rising home prices and record-breaking sales that were experienced in Greater Vancouver for much of this decade,” said REBGV president, Dave Watt.

“It’s also important to note that our December statistics show a third consecutive month of a decrease in active property listings in Greater Vancouver. That means supply is coming down,” Watt said. “Last month was also the first time in 27 years that Greater Vancouver homes sales for December were higher than November.”

Residential benchmark prices, as calculated by the MLSLink Housing Price Index®, declined 10.9 per cent between Decembers 2007 and 2008. Since May 2008, the overall residential benchmark price has declined 14.8 per cent in Greater Vancouver to $484,211 from $568,411.

“For buyers, lower prices haven’t been a concern as much as the perception that prices are falling. It’s difficult to identify the ‘bottom’ of the market. The reality is that people tend to buy when prices are going up, not when they’re going down,” Watt said.

In December 2008, sales of detached, attached and apartment properties totalled 924, a decrease of 51.3 per cent compared to the 1,897 sales in December 2007. New listings for detached, attached and apartment properties declined 8.6 per cent to 1,550 in December 2008

compared to December 2007 when 1,695 new units were listed. Total listings in December declined 17.2 per cent to 15,193 from the 18,348 total active listings in Greater Vancouver in November 2008.

Sales of detached properties in December 2008 declined 48.7 per cent to 348 from the 679 units sold during the same period in 2007. The benchmark price for detached properties declined 11.2 per cent from $730,399 in December 2007 to $648,421 in December 2008. Since May 2008, the benchmark price for a detached property in Greater Vancouver has declined 15.9 per cent.

Sales of apartment properties declined 53.7 per cent last month to 417 compared to 901 sales in December 2007.

The benchmark price of an apartment property declined 11.7 per cent from $377,579 in December 2007 to $333,275 in December 2008. Since May 2008, the benchmark price for an apartment property in Greater Vancouver has declined 14.5 per cent. Attached property sales in December 2008 decreased 49.8 per cent to 159, compared with the 317 sales in December 2007.

The benchmark price of an attached unit declined 7.4 per cent from $456,941 in December 2007 to $423,338 in December 2008. Since May 2008, the benchmark price for an attached property in Greater Vancouver has declined 11.6 per cent.

Friday, January 2, 2009

Case Shiller House Price Index - October 2008 Data