Saturday, May 30, 2009

No Charts for You!

Wednesday, May 27, 2009

House Price Index Indicates Prices are Still Falling

| ||||||||||||||||||||||||||||||||||||||||||||||||

Of the six constituent city indices, four were down from a year earlier: Vancouver (−9.6%), Calgary (−8.4%), Toronto (−6.7%) and Halifax (−0.8%). While prices were still up from a year earlier in Montreal (3.2%) and Ottawa (2.8%), the 12-month increase in those two cities has decelerated markedly in recent months. In Calgary, prices have been correcting for well over a year now - since August 2007 - and are now down 12.7% from the peak of that month. Calgary has shown monthly declines in 16 of the 19 months posted since then, including every month from last July through March. Vancouver prices have also shown nine consecutive monthly declines, and are down 11.7% from peak. Toronto prices have declined seven months in a row and are down 10.8% from peak. Ottawa prices have declined five months in a row and are down 4.3% from peak. A run of three monthly declines in Halifax was interrupted in March, but prices there are 3.0% below their November peak. Montreal prices have held up better. In March they were flat from the month before, down 1.6% from the peak of last September after monthly declines in four of the six intervening months. Teranet – National Bank House Price Index™

The historical data of the Teranet – National Bank House Price Index™ is available at www.housepriceindex.ca.

The Teranet–National Bank House Price Index™ is estimated by tracking observed or registered home prices over time using data collected from public land registries. All dwellings that have been sold at least twice are considered in the calculation of the index. This is known as the repeat sales method; a complete description of the method is given at www.housepriceindex.ca |

Monday, May 25, 2009

Main Entry: fool

Part of Speech: noun

Definition: stupid or ridiculous person

Synonyms: ass, birdbrain, blockhead*, bonehead*, boob*, bore, buffoon, clod*, clown, cretin*, dimwit*, dolt*, dope*, dumb ox, dunce, dunderhead, easy mark*, fair game, fathead, goose*, halfwit, idiot, ignoramus, illiterate, imbecile, innocent, jerk*, lamebrain*, lightweight*, loon, moron, nerd*, nincompoop*, ninny, nitwit, numskull*, oaf, sap*, schlemiel*, silly, simpleton, stooge*, sucker, turkey, twerp, twit, victim

Antonyms: brain

In the vein of thinking about people for who may be the greater of the above synonyms (greater fool), let's discuss this article from the Globe and Mail which highlights a reputable survey from Bing Thom Architects (press release) that has been done regarding the Vancouver housing market. This survey dispels some of the myths surrounding the Vancouver condo market.

Foreign Owners - nope

Vacant condos - no, not really

Investors - yup, yup, yup - 50 to 60%+ of condos are owned by investors

The question is, why do these investors continue to hold onto a low yielding investment like a downtown condo?

The answer is that they believe that the price will rise in the future. In other words, they hope to find a greater fool in the future whom they are able to sell to.

No, there isn't anyone else to blame except local speculators, ahem, investors, who have bid up prices and snapped up developer units at an unprecedented pace over the past few years.

Here is a snippet from the press release:

In addition to an estimate on empty condos, the study found that:

• Condo ownership is a relatively new form of housing for Vancouver. Over 88 percent of condo units in Downtown Vancouver have been built since 1990.

• Less than 40 percent of downtown condos have more than one bedroom.

• The majority of condos are not occupied by the property owner.

• The majority of non-owner occupied condos are owned by BC residents, with a scattering of foreign owners, predominately from the western US states such as California, Washington, and Arizona.

• Owner-occupied units are typically worth $30,000 to $40,000 more than nonowner occupied units, and the more bedrooms the unit has, the more likely it is to be owner occupied.

• A family with one child in the City of Vancouver earning the median income of $75,000 a year would have great difficulty in finding and paying for a condo bigger than one bedroom, even if condo prices were to fall 25 percent below 2008 assessment levels.

That last one is a doozy and despite better career prospects that is why I don't live in Vancouver with my wife and two children.

Friday, May 22, 2009

Dr. Strangedebt - How I Learned to Stop Worrying and Love My HELOC

This post is brought to you by the Joneses.

Yeehaw!! I love my Home Equity Line of Credit - HELOC.

On the path to financial self destruction, I use my HELOC to buy cars, cool gadgets, vacations, consolidate credit card debt, etc. You name it, and I've spent borrowed money on it.

My friends all think I make $150,000 per year but I only make $50,000 but I'm not going to tell them. I'm living the high life, drinking Hennessey, weekends in Vegas, new car every couple years. I'm going to keep doing it too until I collapse under the wieght of all the debt and declare bankruptcy or I'm forced to sell my home and pay off my debts. Every time I go to the bank, they offer me more money and my rates keep going down so it frees me up to do more cool stuff with money I don't have. My house is making me rich because I can just keep getting more money because my house went up in value. I bought my house for $300,000 a few years ago, had a $250,000 mortgage, and now the house is worth $600,000 and I have a $480,000 HELOC. I'm lovin' it. I just keep making those interest only payments of $1500 per month and its all good.

Strange thing happened though, I went into the bank last week to increase my HELOC because my 2007 Lexus RX is getting a little old now and I really want a new one so I need a little bit of money ($25,000) to pay the difference between the trade in and the new car but the mortgage rep at the bank told me that there was no more money and that they wouldn't increase my HELOC - the nerve. I was pissed because I work hard and I deserve that new car. I told her that I was going to take my business elsewhere if she didn't find a way to do it. She laughed at me and wished me luck. I thought to myself 'that was a little strange - that's never happened before' and I went to another bank. I couldn't get an appointment for like a week and today when I went there, they laughed at me too.

I'm starting to get concerned because I can't put up with driving this old clunker around for much longer. Any advice for this poor soul!?

Thursday, May 21, 2009

Landcor Quarterly Report

I will have some thoughts and highlights later.

Saturday, May 16, 2009

Dude, Where’s My Inventory?

I remember a short 4 months ago local real estate blogs and forums were full of predictions of 25,000 to 30,000 active listings in GVREB by summer 2009. Well, it looks like that is going to be a bit of a whiff. The question is, where did all that inventory go?

To answer the question, the first thing to remember is that the population and dwelling count in Vancouver are pretty much fixed. There is of course a steady increase in dwellings as the population grows but, recently, we have seen a significant increase in housing stock above what population growth can fill. When we hear that inventory is down compared to this time last year, it does not mean the housing supply suddenly shrunk. Housing supply for those wanting to buy has shrunk. As mohican’s analysis has shown, reduced supply with higher demand is correlated to higher price changes and an increase in prices recently is not unexpected.

So, where did all this inventory go? Simple: it went back to generating rental income for the owners. There are 2 players in the housing business: landlords and renters; owner-occupiers happen to be both landlord and renter. The number of landlords and renters must balance. That means, effectively, for every landlord who decides not to sell, there must still be a renter available to fill the property (putting “dark” dwellings aside). And for every first-time buyer entering the market, there is an upcoming rental vacancy.

It can be easy to lose track of what really matters with real estate. When there is a long bout of housing oversupply, whether listed for sale or not, both rents and prices will eventually fall, with inherent oscillations of rents and prices along the way. Ultimately the utility provided by housing, in the form of the rents landlords are able to extract from its users, is all that backs prices.

What we are witnessing now is significant wage deflation and dwelling oversupply -- a one-two combination -- meaning overall rents are under pressure. The landlord (or owner-occupier) who has pulled his listing has in essence become a speculator again, but now faces an additional erosion of rents as average wages fall. The speculative game is doomed to fail eventually, though whether one opts for amputation (selling at a loss) or gangrene (low rental yields) is entirely the decision of the patient. I know which one the doctor recommends.

So is the low inventory an indication of a market bottom? No. Looking at the overall dwelling supply compared to the ever-shrinking pool of money available to generate income for these dwellings, we know the endgame.

Wednesday, May 13, 2009

Vancouver CMA Housing Starts - April 2009

There were only 483 housing starts during the month of April. This is really bad news for those working in the construction business.

Developers are continuing to adjust to the new reality of lower sales volume and a distinct lack of speculators to snap up inventory as it is released.

We are perhaps in the 3rd or 4th inning of this correction and it doesn't look like things will get better anytime soon in the Vancouver real estate market. I'll be surprised if they do.

Tuesday, May 12, 2009

Vote Today - Get Informed about the Referendum

Sunday, May 10, 2009

What Mortgage Rates are Saying

NPV = (RENT – EXPENSES)/(5 YEAR MORTGAGE RATE)

If the mortgage rates are approaching 4%, does that mean that many of today’s prices are fairly valued? Is this formula valid in today's environment?

What low long term rates are saying, translated into mortgage rates, is that the market does not expect inflation to be a concern for the next while. That means two things for real estate investors: incomes and rents are unlikely to increase in aggregate and could even fall in the short term. The above NPV calculation, if derived from discounted cash flows, accounts for rental inflation by offsetting the denominator against inflation. We are left with a denominator that should contain the discount rate minus inflation. With mortgage rates low, what are banks saying, and should we really be using the 5 year rate in the denominator?

Tuesday, May 5, 2009

Fraser Valley Real Estate - April 2009

Sales were 1,293 and are at quite low levels compared to recent years.

Active listings have not grown as much as last year for some reason. I expect this may change as job losses mount and sales slow down.

Months of inventory has fallen dramatically but remains at a high level of 7.6 and April or May are traditionally the lowest month for MOI. This bodes ill for those expecting price increases in the remainder of 2009.

Prices and MOI are very tightly linked and this relationship remains resilient.

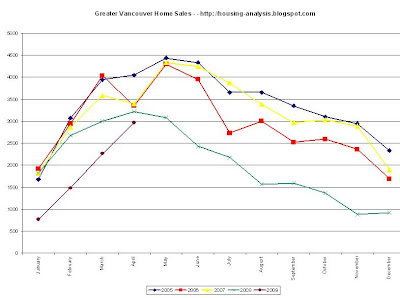

Vancouver Real Estate - April 2009

VANCOUVER, B.C. – May 4, 2009 – With more buyers and fewer homes for sale in recent months, the Greater Vancouver housing market has entered a more moderate and balanced state.

For the sixth consecutive month, new listings for detached, attached and apartment properties declined in Greater Vancouver, down 33.7 per cent to 4,649 in April 2009 compared to April 2008, when 7,010 new units were listed. The total number of property listings on the Multiple Listing Service® (MLS®), while slightly down compared to last month, remains un-changed compared to the same period in 2008.

The Real Estate Board of Greater Vancouver (REBGV) reports that residential property sales in Greater Vancouver totalled 2,963 in April 2009, a decline of eight per cent from the 3,218 sales recorded in April 2008, and an increase of 31 per cent compared to last month.

We’'re seeing greater balance in the housing market, as evidenced by a strong sales to active listings ratio of over 19 per cent,” Scott Russell, REBGV president said. “The result is a relatively stable market in which homes are being realistically priced.

The bridge between buyer demand and housing supply is continuing to narrow, which, as we see, helps bring stability to home prices,” he said. “The trends in our housing market over the last couple of months offer a much more comfortable, historically normal set of conditions.”

Sales of detached properties declined eight per cent to 1,190 from the 1,293 detached sales recorded during the same period in 2008. The benchmark price, as calculated by the MLSLink Housing Price Index®, for detached properties declined 12.2 per cent from April 2008 to $675,268.

Sales of apartment properties in April 2009 declined 10.5 per cent to 1,179, compared to 1,317 sales in April 2008. The benchmark price of an apartment property declined 12.6 per cent from April 2008 to $340,203.

Attached property sales in April 2009 are down 2.3 per cent to 594, compared with the 608 sales in April 2008. The benchmark price of an attached unit decreased 9.7 per cent between April 2008 and 2009 to $431,759.

Statistics:

Sales are rising as per the normal seasonal fluctuation. Sales are still at low levels compared to the previous four years.

Active listings have been held down because of the rise in sales and it seems that people are not listing as much this year as compared to last. We will see if that trend holds through the summer months.

With higher sales and lower listings the months of inventory has fallen to a normal seasonal level in 'balanced' market territory. If we see normal seasonal changes in sales and listings, it would appear that MOI will be flat to rising for the remainder of the year now. This will put more negative pressure on prices.

Several people have mentioned that the price increase witnessed in April was abnormally high and I would suggest that it is what should be expected given the level of MOI that was in the market during the month. The quarterly price change witnessed in April falls exactly on the trendline.

As mentioned earlier, I expect MOI to stay flat in May and rise for the remainder of the year and prices should fall if that is the case. We will see.

Monday, May 4, 2009

Condos and Detached Sales in Vancouver

The interesting thing is the marked shift in 2004 to a permanently high ratio of around 1.1 or so. I have suspicions the reporting may have changed at that time but, suspending this possibility for a moment, we can see a few things.

There are proportionally more condo sales in the second half of the decade than the first. This fits with the trend of more condos being built so it tells us that condos are being traded more than they were before and/or there are more condos to trade.

The other thing to note is that, relatively speaking, April and May are generally the strongest months for SFH sales compared to condos. Hard to see; it's a weak relationship. This would fit with when common sense would dictate families would buy so as to move in during the off-school summer months. It looks like this year the move-up market is still in a buying mood. We shall see how well the real estate food chain supports them.

I was looking for data to indicate if 2009 is seeing a different trend from other years. Starting in 2007, there is more volatility in the sales mix with April-May having a higher mix of detached. It will be interesting to see if a similar trend follows again this year. It does not tell me too much, unfortunately. Total sales volume in 2007 and 2008 had larger drops after May than other past years, though it is too early to tell if 2009 will share this trend.