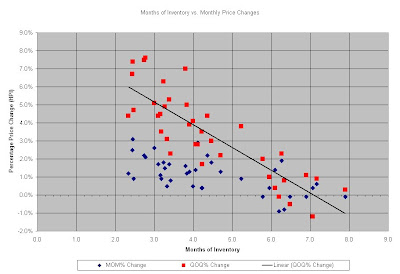

Sales were down 7% from last year. Listings were up 30% from last year. We are on a similar trend as US markets that have entered the decline stage already with listings increasing and sales decreasing it is only a matter of time. Months of inventory typically falls until April / May but in a cooling market at the limits of affordability we could be surprised at inventory levels that refuse to fall which would put a lot of pressure on prices.

Amazingly, prices were higher in all categories. I don't know where people get the money but they must be getting it somehow.

Year over year price changes seem to be levelling off in the 7-8% range. We saw a big increase in the Benchmark House Price Index during February with a 1.9% appreciation.

Months of inventory was 6.0 during February which indicates a fairly balanced market with not too much upward or downward price pressure. Any amount of supply greater than 7 is highly bearish and a sustained level above 6 is quite bearish.

These numbers blow me away. I did not expect sales to be as strong as they were proving once again that human behaviour is difficult to predict and that mortgage money must be still quite easy to come by. Oh well, the higher we go the farther we fall.

For comparison purposes here is a chart from Calculated Risk outlining the Months of Inventory for the US housing market. The Fraser Valley area looks comparable to February 2007 on this chart right now. If we see sales continue to slow and inventory shoot up during the spring months then we will see big price decreases by the end of the year just like the US did last year.

No comments:

Post a Comment