Thursday, July 31, 2008

Monthly Speculation

This means that our current inventory levels are higher than the bubbliest of bubbly US markets and sales still have further to fall which is going to put even more pressure on prices. I fully expect Months of Inventory to be well above 10 by September / October and even higher in the wintertime. The pressure for price declines will be enormous as some sellers will need to sell and they'll have to cut their price dramatically in order to do so.

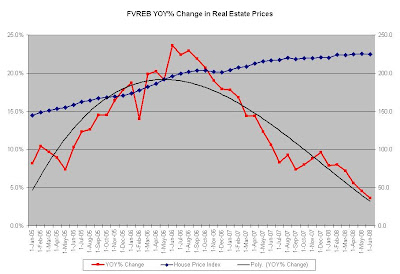

We've discussed price changes before and the relationship between price changes and the supply / demand function (Months of Inventory). Given that relationship, if April was the official top of the market for prices, July should prove to be the month that the market turned sharply negative in terms of price changes.

My personal speculation is that benchmark prices will likely be down 2.5% give or take 1%. What's your thoughts?

Tuesday, July 29, 2008

TD Economics - The US Housing Market

- U.S. home construction shows signs of life

- Global inflation and growth woes remain

In the 1980s, economist and Nobel laureate Amartya Sen found that famines tend to happen not because of a lack of food, but because of obstacles preventing those in need from acquiring the existing stores of food. This juxtaposition is center stage across the globe right now – an ongoing famine for liquidity in many financial and housing sectors versus the flood of petro-liquidity driving consumer and producer inflation higher worldwide. We have liquidity in spades, just not in the sectors that welcome it or need it most.

Why so serious?

Remember April and May? The leaves were returning. The flowers were blooming. The credit crunch was over. Well, the spring fling is over and markets have come to the realization – which incidentally has been TD Economics base case scenario all along – that the credit crunch will continue to slowly bleed for some time. While the market roller coaster saw increasing optimism early this week, apparently markets forgot that the U.S. housing market remains in shambles. There is some light. For the first time since the spring of 2007, the 3-month trend in new home sales and starts is positive. New home construction is what is captured in GDP measures of residential investment, and this same signal preceded rebounds in U.S. residential investment in each of the last three downturns. Existing home sales, on the other hand, make up the majority of the U.S. housing stock and mortgage market, and sales there dropped another 2.6% M/M in June and are down over 15% over last year. Critically, at this current pace of sales, it would take over 11 months to sell the inventory of unsold homes already on the market. And this doesn’t include other homes dumped on the market in coming months through foreclosure or voluntary sales. In the second quarter, one in every 171 U.S. households was foreclosed on – with Nevada showing a staggering one in 43 households and California one in every 65.

This is the heart of the liquidity famine. As more homes are dumped on the market, home prices fall further, driving further mortgages underwater, leading to further foreclosures, further homes dumped on the market, and further home price declines. Lather. Rinse. Repeat. At some point, lower prices will entice buyers into the market, but not until the expectation for further declines recedes. Why buy today when you can buy next year for 10% less? In the meantime, liquidity in the housing market is nonexistent. This feeds directly into the current dilemma for the financial sector. The smaller and more regional the bank, the more exposed to the mortgage market. Real estate loans account for 1/3 of all assets of U.S. commercial banks – over ½ of all assets for banks with total assets less than $1 billion – and nearly 2/3 of assets of savings and loans. This puts these institutions in a vise, and those like Fannie and Freddie that have bought or underwritten about half of all these mortgages in a bind. As a result, commercial banks’ average daily borrowing of $16 billion from the Fed’s emergency lending programs last week was the highest ever.

So the issue becomes what can be done to get that liquidity flowing again? In a perfect world, we’d let the market work itself out. Prices would fall to the point that buyers would move in, and larger banks would recapitalize by attracting investors. But current regulations limit the ability of buyout firms to move into the banking sector – an issue the Federal Reserve is reportedly trying to address – while large foreign investors that bought into large banks earlier have since lost money on their investments and may be once bitten, twice shy. The bill moving through the U.S. Congress right now hopes to help stop the self-fulfilling prophesies of doom, gloom, and liquidity vacuum. The government would increase its debt ceiling by about $800bn – about half of which could cover the expected 2008 federal deficit and the other half would be there just in case. This “just in case” would help cover, among other things, the federal government insuring approximately $300bn in mortgage debt belonging to 400,000 American households who will refinance their subprime loans into 30-year fixed-rate mortgages, $4bn in federal transfers to the states, and the ability of the U.S. Treasury to buy stock in Fannie and Freddie up to the federal debt ceiling. As banks continue to struggle, these two institutions are key to helping the U.S. mortgage market grind on. While not ideal, a government backstop may be just what is needed to avoid their failure and the vicious cycle in the mortgage market. Earlier this week, the Congressional Budget Office estimated the cost of the Fannie and Freddie rescue plan at $25bn. As with most of the estimates placed on the cost of credit crunch, this seems likely to creep higher, but is still much lower than the cost of doing nothing. In the worst case scenario – or even just the next incremental step because let’s be honest, there isn’t much of a difference between the first step off the cliff and the second – the costs to the Federal government could be ten times higher.

A horse with no name

The current U.S. predicament is core inflation and GDP growth both running at about a 2.5% pace over last year. For those unlucky few who need to buy gas and food on a regular basis, total inflation is running at twice that pace. Still, this is well short of the near 15% pace of core inflation and 1% Y/Y contraction in U.S. GDP in 1980 that saw the invention of the moniker “stagflation.” Nor are there signs inflation will come unhinged in the U.S. to that extent so the “stag” part is much more likely than the “flation.” Similarly in Canada, headline inflation is now running at twice the pace of core inflation (3.1% vs. 1.5%). In fact, on a global scale, the most likely scenario is further stagnation in advanced economies and further inflation for emerging markets, with very few of either seeing both on a sustained basis. The U.S. consumer is quickly running out of stimulus checks to spend. In Canada, retail sales for May showed an ongoing sharp deceleration in everything not being bought at a gas station. In Europe, surveys of the manufacturing and service sectors showed sharper than expected decelerations in Q2. The U.K. economy posted its weakest quarterly GDP growth rate in three years in 2008Q2 and is likely to contract before the year is out. And, the pace of exports from Japan and Hong Kong saw precipitous declines in June. So growth is likely to slow in these regions and exert a downward pressure on domestic inflation.

On the other hand, broad-based emerging market resilience and inflation worries remain. The pace of inflation-adjusted retail sales in China is the highest in 12 years. Korea’s economic expansion stayed constant in Q2 while inflation remains at a 10-year high. And across the EM universe (or at least averaging 57 EMs), inflation has accelerated from a 5% pace in June 2007 to 12% in June 2008. So while Malaysia this week hiked interest rates for the first time since 2006, and Brazil surprised markets with a larger than expected rate hike, the average pace of inflation across EMs is rising faster than the average interest rate. This is pushing down real interest rates and helping to fuel both faster growth and inflation in these markets. The same is not occurring in advanced economies, with average real rates still above zero in the G-7.

So in the immortal words of the modern philosopher Axl Rose, “Where do we go now?” Sluggish economic growth in advanced economies is likely to keep a lid on growth prospects in EMs, but not unbearably so. Inflation in EMs is likely to place upward pressure on advanced economy inflation, but not uncontrollably so. And we are likely to see more mirages in the desert before we finally find paradise and bring balanced liquidity back to the global economy.

Richard Kelly, Senior Economist416-982-2559

Sunday, July 27, 2008

How to Control Your Fears In a Fearsome Market

How to Control Your Fears In a Fearsome Market

Saturday July 19, 1:05 am ET

By Jason Zweig

What goes on inside your head when your portfolio implodes?

One of the fear centers in your brain, the amygdala, can respond to upsetting stimuli in 12 milliseconds, or one-25th the time it takes to blink your eye. These brain cells fire when an attack dog snarls at you, a spider drops down your shirt or the Dow Jones Industrial Average takes a dive.

Merely reading the words "market crash" in this sentence can instantaneously jack up your pulse and your blood pressure, the output of your sweat glands and the tension in your muscles. Stress hormones will flood your bloodstream. Your eyes will widen and your nostrils flare, making you hypersensitive to any further danger. All this occurs automatically, involuntarily and unconsciously. You can't be an intelligent investor if, without even knowing it, you are thinking with the panic button in your brain.

The countless people who bailed out of the market in the horrifying plunge of October 2002 missed out on the generous returns of 2003 through 2007, when stocks returned 12.8% annually. The same is likely to be true of those who cut and run in today's turbulent market.

Fortunately, you can train your brain to stay calm when the markets are gripped by panic. Last week, I spent an afternoon in Kevin Ochsner's neuroscience lab at Columbia University in New York, practicing what he calls "cognitive reappraisal."

I sat at a computer and viewed a series of photographs, each preceded by one of two words: look or reappraise. look was my cue to respond naturally without trying to change my feelings. reappraise told me I should "actively reinterpret" the photo, using my imagination to spin another, less emotional scenario that could have resulted in the same image.

Dr. Ochsner had warned me to eat an early, light lunch, and I immediately realized why: I gasped at the sight of a man's hand from which most of the fingers had been freshly hacked off. But my instruction had been to reappraise, so I forced myself to ask whether this image might actually be a still from a horror movie. Magically, the moment I imagined it was a film prop, the raw flesh seemed to look a bit like plastic, and I felt myself exhale.

If I can think away blood, you can calmly face the red arrows on a market Web site. "Emotions are malleable," Dr. Ochsner said, "but people often don't realize how much [of what you feel] is under your own control."

Here are some ways you can control your fears.

Reappraise. Forget what you paid for that stock or fund; instead, imagine it was a gift. Now that it is priced, say, 20% more cheaply than in December, should you want to return the gift? Or should you buy more while it is on sale? (If rethinking a fallen price this way doesn't make you feel better, maybe you should sell.)

Step outside yourself. Imagine that someone else has suffered these losses. Think of questions you might ask to give that person advice: Other than the price, what else has changed? Is your original rationale for this investment still valid?

Control your cues. Even witnessing someone else's pain, or glancing into another person's frightened eyes, can fire up your amygdala. Because fear is as contagious as the flu, quarantine yourself from anyone who obsesses over the momentary twitching of the Dow. Tear yourself away from the computer or television; better yet, while the market is closed, make an advance date with friends or family to get your mind off stocks during market hours.

Track your feelings. Fill in the blanks in this sentence: "Today the Dow closed down [or up] ___ points, and that made me feel __________." Your emotions shouldn't be hostage to the actions of the roughly 100 million other people who compose the collective beast that Benjamin Graham called "Mr. Market." You need not be miserable just because Mr. Market is.

Finally, if the market is open, your portfolio should be closed. Sleep on any sell decision until the next day, when your fears may have faded. Intelligent investors act out of patience and courage, not panic.

Tuesday, July 22, 2008

June 2008 CMHC Data

There were 1730 new dwelling starts during June.

There were 1600 completions during June.

There were 26444 new dwellings under construction in the Vancouver area during June.

I have a feeling that we've seen the cycle highs for dwelling starts and units under construction and it is probably all downhill from here at this point. We can keep an eye on these numbers each month to see if that holds true. There is a lot of current inventory which will hold back developers from starting as many projects as they have been and this will free up labour to work on the existing projects. I'm looking for the completions to speed up dramatically by the end of this year and for the units under construction to drop to its normal levels below the annual number of starts and completions. This process will probably take at least 18 months. I expect the prospects for construction employment to be extremely negative by the end of 2009 in the Vancouver area.

Monday, July 21, 2008

Friday, July 18, 2008

Wednesday, July 16, 2008

Hindsight bias

Hindsight bias is the inclination to see events that have occurred as more predictable than they in fact were before they took place. Hindsight bias has been demonstrated experimentally in a variety of settings, including politics, games and medicine. In psychological experiments of hindsight bias, subjects also tend to remember their predictions of future events as having been stronger than they actually were, in those cases where those predictions turn out correct.

Prophecy that is recorded after the fact is an example of hindsight bias, given its own rubric, as vaticinium ex eventu.

One explanation of the bias is the availability heuristic: the event that did occur is more salient in one's mind than the possible outcomes that did not.

It has been shown that examining possible alternatives may reduce the effects of this bias.

Classic studies

Paul Lazarsfeld (1949): Lazarsfeld gave participants interpretive statements that seemed like common sense immediately after they were read, but in reality the opposite was true.

Karl Teigen (1986): Teigen gave participants proverbs to evaluate. When participants were given the proverb "Fear is stronger than love", most students would rate it as true; when given its opposite ("Love is stronger than fear"), most would also rate that as true.

Phrases

The following common phrases are expressions or terms for hindsight bias:

- "I told you so!"

- "With the wisdom of hindsight."

- Retrospective foresight

- 20/20 Hindsight

- Monday morning quarterback

Suspicious Condo Fire

A 4 storey apartment complex under construction has been levelled by fire in Abbotsford. The blaze was reported around 11:30 pm and fire crews arrived to see flames shooting into the night air.Deputy Fire Chief Mike Helmer says the fire burned quickly, "It started quickly and ended quickly because it was under construction. It burned very fast, flames over a hundred feet in the air. Surrounding buildings were slightly damaged but they didn't start on fire."Helmer says there were no injuries.McCallum Road is closed between Cannon Avenue and Holland, while Marshall Road is closed between Horizon and Cherry.

http://www.thecrossingcondos.com/

Perhaps "The Crossing Condos" weren't going to measure up to the hype. Spring 2009 occupancy doesn't look like it is going to happen now. I wonder if many of the units were actually sold or if the fire was a convenient escape for the developer or presale buyers.

Monday, July 14, 2008

What to do?

Now here is the background for my question:

I have found a home for sale that would likely meet my criteria. My criteria is this:

1) Walking distance to grocery store and other shopping (10 minutes or less). Preferably a rec centre as well.

2) Within 5-10 minutes drive to work. Preferably walking distance.

3) Does not need any major repairs or updates.

4) Price must meet pricing standard as follows:

Fair Price = {[1/(5 Year mortgage rate)*100] * [Annual Rent (estimate) - Annual Strata Fees/Maintenance - Annual Property Taxes]}

This is how my formala works out in this specific case:

Fair Price = (1/5.7%*100)*(19,200 - 2,000 - 1,500)

Fair Price = 17.5 * 15,700

Fair Price = $275,378

The asking price is higher than the current fair price but I'm fairly certain that I could get my fair price in the next couple months if conditions stay as they are. The price was just reduced 10% so it popped onto my radar.

But here is the question: Should a person purchase with the full knowledge that the property they are purchasing will likely fall in value even further? Why or why not?

I am personally comfortable with the risk of further price declines as long as the fair price criteria is met but I may not be the norm. I will also be purchasing with a 30-40% downpayment and well below my affordability level as the lenders see it so even temporary job loss wouldn't be a major issue.

US Mortgage Bailout

By Carol Massar and Eric Martin

July 14 (Bloomberg) -- The U.S. Treasury Department's plan to shore up Fannie Mae and Freddie Mac is an ``unmitigated disaster'' and the largest U.S. mortgage lenders are ``basically insolvent,'' according to investor Jim Rogers.

Taxpayers will be saddled with debt if Congress approves U.S. Treasury Secretary Henry Paulson's request for the authority to buy unlimited stakes in and lend to Fannie Mae and Freddie Mac, Rogers said in a Bloomberg Television interview. Goldman Sachs Group Inc. analyst Daniel Zimmerman predicted the mortgage finance companies' shares may fall another 35 percent.

``I don't know where these guys get the audacity to take our money, taxpayer money, and buy stock in Fannie Mae,'' Rogers, 65, said in an interview from Singapore. ``So we're going to bail out everybody else in the world. And it ruins the Federal Reserve's balance sheet and it makes the dollar more vulnerable and it increases inflation.''

The chairman of Rogers Holdings, who in April 2006 correctly predicted oil would reach $100 a barrel and gold $1,000 an ounce, also said the commodities bull market has a ``long way to go'' and advised buying agricultural commodities.

Rogers, a former partner of hedge fund manager George Soros, predicted the start of the commodities rally in 1999 and started buying Chinese stocks in the same year. He traveled the world by motorcycle and car in the 1990s researching investment ideas for his books, which include ``Adventure Capitalist'' and ``Hot Commodities.''

Stocks Rise

Fannie Mae and Freddie Mac each surged more than 20 percent in pre-market trading today after Paulson moved to stem a collapse in confidence in the two companies that purchase or finance almost half of the $12 trillion in U.S. home loans.

``These companies were going to go bankrupt if they hadn't stepped in to do something, and they should've gone bankrupt with all of the mistakes they've made,'' Rogers said. ``What's going to happen when you Band-Aid and put some Band-Aids on it for another year or two or three? What's going to happen three years from now when the situation's much, much, much worse?''

Freddie Mac rose 22 cents, or 2.8 percent, to $7.97 at 10:13 a.m. in New York Stock Exchange trading, while Fannie Mae rose 73 cents, or 7.1 percent, to $10.98. Paulson's proposal, which the Treasury anticipates will be incorporated into an existing congressional bill and approved this week, signals a shift toward an explicit guarantee of Fannie Mae and Freddie Mac debt.

The Federal Reserve separately authorized the firms to borrow directly from the central bank.

Last Week's Slump

Washington-based Fannie Mae slid 45 percent last week, while McLean, Virginia-based Freddie Mac sank 47 percent on concern they may require a bailout that would wipe out shareholders.

Former St. Louis Federal Reserve President William Poole last week said in an interview that Freddie Mac is technically insolvent under fair value accounting, which measure a company's net worth if it had to liquidate all its assets to repay liabilities. Poole said Fannie Mae may also become insolvent this quarter.

Goldman's Zimmerman said today the U.S. government's plan to rescue Fannie Mae and Freddie Mac won't benefit shareholders. He lowered his share-price estimate for Fannie Mae to $7 from $18 and for Freddie Mac to $5 from $17.

Rogers said he had not covered his so-called short positions in Fannie Mae and would increase his bet if it were to rally. Short sellers borrow stock and then sell it in an effort to profit by repurchasing the securities later at a lower price and returning them to the holder.

The U.S. economy is in a recession, possibly the worst since World War II, Rogers said.

``They're ruining what has been one of the greatest economies in the world,'' Rogers said. Bernanke and Paulson ``are bailing out their friends on Wall Street but there are 300 million Americans that are going to have to pay for this.''

Sunday, July 13, 2008

Warren Buffett gets busy

By Paul R. La Monica, CNNMoney.com editor at large

Last Updated: July 10, 2008: 10:24 AM EDT

NEW YORK (CNNMoney.com) -- American consumers aren't the only ones going shopping. So is Warren Buffett.

Stocks initially rose Thursday morning thanks to better-than-expected sales reports from Wal-Mart (WMT, Fortune 500) and other top retail chains.

But the other big corporate event of the day was the news that Dow Chemical (DOW, Fortune 500) agreed to buy rival specialty chemical maker Rohm & Haas (ROH, Fortune 500) for $78 a share, a whopping 74% premium to yesterday's closing price.

Dow is getting some help to finance the deal, including money from a Kuwaiti sovereign wealth fund and none other than Berkshire Hathaway (BRKA, Fortune 500), the investment arm of Buffett.

This is interesting since it marks the second time in the past few months that Berkshire has taken part in a high-profile deal.

In April, Berkshire agreed to help privately held Mars finance its $23 billion takeover of The Wm. Wrigley Jr. Company, the gum and candy maker. Berkshire also said it was taking a $2.1 billion stake in Wrigley (WWY, Fortune 500).

It all just goes to show that Buffett is not panicking in this rocky market and is instead searching for opportunities.

To be sure, Buffett is not ignoring the obvious bad news about the economy. He's said in numerous interviews this year that he believes the economy is already in a recession and that it could be worse than some fear.

But Buffett is putting things in perspective. Recession does not equal the second Great Depression or economic Armageddon. Rather, Buffett seems to be following the tried and true investing axiom that the best time to make long-term bets is when fear is at its peak.

And make no mistake, this is a market ruled by fear right now. Investors are scared that oil prices are going to head even higher due to the uncertainties in Iran. They are afraid that mortgage financing giants Fannie Mae (FNM, Fortune 500) and Freddie Mac (FRE, Fortune 500) may need a government bailout.

Keep in mind, Buffett isn't making trading calls here. So his recent activity doesn't necessarily mean that the markets can't still head lower in the next few months.

What Buffett is doing though, is signaling that this is not a time for investors to be overly cautious. Stocks are still a good bet for the long haul.

For example, he told Fortune's Carol Loomis earlier this year that he has a bet with New York investment firm Protege Partners about where the market is going to head in the next 10 years. Buffett is betting that the S&P 500 will post a bigger return than a group of top hedge funds over the next decade.

In addition, Berkshire has also made some very contrarian bets in financial services this year that only can be justified by a belief that the market turmoil has created some deep values in that beaten-down sector.

In the first quarter of this year, Berkshire increased its stake in regional banks Wells Fargo (WFC, Fortune 500), U.S. Bancorp (USB, Fortune 500) and M&T Bank (MTB). Berkshire also boosted its exposure to some consumer stocks in the quarter, most notably food giant Kraft (KFT, Fortune 500) and used car retailer CarMax (KMX, Fortune 500).

At the end of the day, investors should be reassured that the Oracle of Omaha is staying busy. Yes, it certainly seems like a frightening time right now to invest. But if Buffett's not hiding under the bed, why should you?

Friday, July 11, 2008

Is it time to buy stocks yet?

I can't say whether stock prices will go up or down but as a student of market history I am interested in what the past can teach us. Have a look at this chart which tracks the Price to Earnings ratio of the 500 largest companies in the United States from 1950 to 2008. The index levels are significantly lower now and accordingly the P/E ratio is also lower now.

The US markets were down another 10% during June and more so far during July. Worry about the economy and the financial system is on every news channel and there are very few bright spots. Corporate earnings are expected to be under pressure over the next 12 to 24 months as it is likely that the US is in recession and the hangover from falling house prices bites into corporate profits. This will affect the 'E' part of the P/E ratio for the next while. Stock prices are also forward looking and are already pricing in the prospect of lower profits.

Personally, I have a long time horizon and I'm always buying as part of a systematic investment plan but I'm much happier buying today than 1 year ago.

Wednesday, July 9, 2008

Government of Canada Moves to Protect, Strengthen Canadian Housing Market

Big news - this is going to put another nail in the coffin of the Vancouver Real Estate Market and it is exactly the kind of catalyst I thought the market needed to push us over the edge. See the Press Release:

The Government of Canada today announced adjustments to the rules for government guaranteed mortgages aimed at protecting and strengthening the Canadian housing market. The new measures include:

- Fixing the maximum amortization period for new government-backed mortgages to 35 years;

- Requiring a minimum down payment of five per cent for new government-backed mortgages;

- Establishing a consistent minimum credit score requirement; and

- Introducing new loan documentation standards.

The new limits are planned to take effect October 15, 2008. This would allow existing mortgage pre-approvals with the common 90-day duration to be used or expire. Certain exceptions would also be permitted after October 15. The Government will work closely with all stakeholders to ensure timely and effective implementation of these measures.

As these measures relate only to new, government-backed insured mortgages, Canadians who already hold mortgages will not be affected by this announcement.

The measures announced today will build on the strength of Canada’s housing market. According to the International Monetary Fund, the increase in house prices in Canada is based on sound economic factors such as low interest rates, rising incomes and a growing population. A recent Statistics Canada report concluded that home ownership is at record levels, with over two-thirds of Canadians owning their own home.

Mortgage arrears—overdue mortgage payments—have also remained low. In recent years, the percentage of mortgages in arrears for three months or more continues to be at low levels not seen since 1990.

Tuesday, July 8, 2008

FVREB - June 2008 Stats

Sales were 1,418 - down 31% compared to June last year.

Active Listings were 11,295 - up 47% compared to June last year.

Months of Inventory stands at 8 months at the current sales pace.

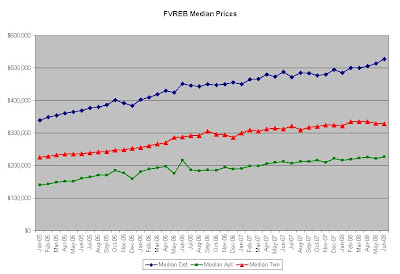

Median prices were mixed in June with detached and apartment prices rising and attached prices falling.

The benchmark price fell -0.3% during June and year over year the benchmark price has risen only 3.6%. We are fast approaching negative year over year price changes.

The price changes last month fell within the expected range when looking at the months of inventory metric. Prices will continue to fall while the months of inventory remains high.

Cheers.

PS - Kudos to the FVREB staff for issuing the corrected data for the active listings after they changed they way the data is measured last month.

Upper Valley Real Estate - June 2008

There were 237 residential sales compared to 365 last year for a 35% decrease in sales activity.

There were 1959 active listings as of June 30 compared to 1063 last year at the same time for a whopping 84% increase in inventory.

Months of inventory stands at 8.26 months which is well into the area needed to bring negative price changes.

The press release put out by the board is useless and unprofessional. The CADREB does not compile a benchmark price or track/release median prices so it is difficult to say what the price changes have been so far. Anecdotally we are already at YOY % price declines according to some.

Monday, July 7, 2008

REBGV Statistics - June 2008

Real estate sales volume in the Vancouver area plummetted nearly 43% when comparing June 2008 to June 2007.

Active Listings are skyrocketing due to the surge of new listings combined with the lower sales numbers. Active listings in the Vancouver area are up nearly 53% when comparing June 2008 to June 2007.

The Sales to Listings ratio is extremely low and well into "buyer's market" territory even when comparing the normally hot market of June to the slower winter market. Although we are far from an attractive entry point for new buyers, including this humble blogger.

The Months of Inventory is shooting up so fast it is even astonishing this ardent real estate bear blogger. We are poised for a rapid turnaround and this will likely be viewed as the turning point by many analysts.

The relationship between supply, demand and prices should be obvious to any Economics 101 student but here it is in black and white (and red and blue) for us.

REBGV and FVREB Press Releases

Prices ease slightly as unsold properties are up by 54 per cent over '07

Derrick Penner

Vancouver Sun

Friday, July 04, 2008

Lower Mainland house hunters are now in a buyer's market with prices that have eased slightly off of earlier-year highs, according to the latest report from the Real Estate Board of Greater Vancouver.

The region saw 2,425 sales registered through the Multiple Listing Service in June, the board reported, a 43-per-cent decline from the same month a year ago.

At the same time, owners listed 6,546 properties, an 18-per-cent increase from the same month a year ago. On June 30, Greater Vancouver's inventory of unsold properties stood at 18,260, a 54-per-cent increase from a year ago.

And while so-called benchmark prices in June were still up over the same month a year ago, in many markets typical prices were down slightly from benchmark prices in May.

The Greater Vancouver benchmark price for a detached house was $765,654 in June, up 7.3 per cent from the same month a year ago, but down from the May benchmark of $771,250.

"When a market is in buyer's market conditions, there is little upward pressure on home prices," which is reflected in those May-to-June changes Cameron Muir, chief economist for the B.C. Real Estate Association said in an interview.

However, Muir doesn't see any factors that would drive prices down. - - Um, didn't prices just go down Cameron??

Consumer confidence is lower than it was a year ago and Vancouver's high prices have squeezed some buyers out of the market, Muir said, but the region's overall economy remains strong with solid job creation and positive levels of population migration.

"There is no indication, at this point, of any kind of substantial decline in prices," he added.

Dave Watt, president of the Real Estate Board of Greater Vancouver, said the homes that are selling are still selling relatively quickly, but the market is becoming increasingly competitive.

"The buyer sure knows about your competition, because of the power of the Internet," Watt said. "For sellers today, you'd better know about your competition."

Maple Ridge realtor Ron Antalek, with Re/Max Ridge Meadows, said it is the sellers who still try to set new all-time highs with their prices that are watching their properties sit.

"In general, the average [price] is reasonably stable, but not really showing any price increases," Antalek added. "We're seeing sale prices, in some occasions, equal to last year."

Watt said realtors are starting to see more sellers reduce their asking prices. Fraser Valley markets also showed a slowing of sales and rising inventories that pushed the region into buyer's territory.

Fraser Valley realtors recorded 1,418 MLS sales, a 31-per-cent decline from the same month a year ago.

At the same time, 3,236 new listings hit the market, bringing the valley's total inventory of unsold homes to 11,295, a 47-per-cent increase from the same month a year ago.

The Fraser Valley's average detached house price hit $561,771 in June, a six-per-cent increase from the same month a year ago. Stats picking - the benchmark is only up 3.5% YOY.

Muir added that he expects to see some balancing out in the market as the year progresses as sellers readjust their expectations and either re-price their properties given today's realities, or pull their listings off the market. But Cameron, what if the seller MUST SELL??