Jacqueline Thorpe, Financial Post Published: Wednesday, October 01, 2008

The Canadian housing market could face a similar housing bust to the United States, particularly in more bubbly markets as Vancouver and Calgary, said Robert Shiller, the University of Yale professor who predicted both the 1990s stock market boom and bust and the US housing slump.

Mr. Shiller, co-founder of the S&P Case/Shiller Home Price Index, said psychology is the primary driver of bubbles and it appears that Canada has been caught up with home buying fever just as the United States and other countries around the world.

Asked whether that meant Canada could face a similar bust Mr. Shiller said: "Yes, especially in places that went up a lot like Vancouver and Calgary. I don't think Toronto has been quite as extreme."

Mr. Shiller said there was a natural connection between the United States and Canada.

"I would be surprised that the bubble that appeared in the United States and elsewhere didn't appear in Canada," he said in an interview with the Financial Post. "It's psychology, I think that drives it.

Mr. Shiller, whose book Irrational Exuberance came out in March 2000 just as the tech bubble peaked, said it was essential for the U.S. government to pass a financial bailout, though he believes the United States is facing a "severe recession," regardless.

"I'm concerned problems are deeper than can be handled by the bailout but that doesn't mean the bailout doesn't do some good," he said.

He said a bailout might help restore some confidence to the stressed financial system.

"What creates a crisis is a lack of confidence," he said.

He said the housing crisis was primarily a policy failure by U.S. authorities.

The U.S. government was "totally blind" to it, regulators failed to monitor the mortgage industry properly and the U.S. Federal Reserve had very low interest rates at a time of the greatest housing bubble of all time.

While homeowners should take some personal responsibility for the debacle, they were being goaded into the fevour by an establishment that endlessly pushed an ownership society.

"They were doing what was considered right at the time," Mr. Shiller said.

Mr. Shiller said human nature seems to predispose people to spectacular excess, fanned by a voracious news media.

"Until we had newsapers and other media we had no bublbles, he said.

While ups and downs in the market can lead to creative destruction the current housing crisis has morphed into a system problem.

"The problem is that perfectly good firms are in trouble," he told the Financial Post in an interview at the Ontario Economic Summit.

A bailout may not be palatable, government assistance is required when the system fails.

The trick is to reduce conditions that fan bubbles.

In his current book, "The Subprime Solution," Mr. Shiller proposes several measures to reduce bubble conditions in the housing market including better information for prospective buyers and broader markets that trade risk better, such as the housing futures he has developed on the Chicago Mercantile Exchange.

There should also be new retail products such as "continuous workout mortgages," that go up and down with the value of the home equity and mortgage equity insurance.

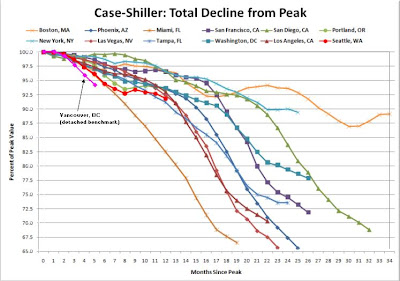

Mr. Shiller, who would not give a precise forecast on the outlook for U.S. home prices, nevertheless said futures markets are predicting more price declines of 10% or more. His Case/Shiller index earlier this week showed home prices down 16.3% year-over-year this summer.

He expects things to get worse for the U.S. economy in the short-term.

"We're going to have a severe recession, most likely," he said. How quickly the economy recovers depends on policy.

"Unfortunately the bailout has hit a snag," he said. "There is resentment of rich Wall Street people. I am worried that the sense of trust, in confidence of each other is being damaged."

Mr. Shiller said he does not have another bubble in his sights as the U.S. economy will be "damaged for years."

"The housing bubble was of record proportions," he said. "Maybe the next big bubble will be your children's or grandchildrens...The excitement we had in the 1990s and in 2000 in the housing market is a fragile thing and it won't come back for some time."