Monday, May 31, 2010

Florida Home Sales Increase +27% in April

Existing home sales rose 27% last month with a total of 16,781 homes sold statewide compared to 13,244 homes sold in April 2009 (see chart). Statewide existing home sales last month increased nearly 3 percent over statewide sales activity in March. Meanwhile, April's statewide existing-home median price was 2.3% higher than March's statewide existing-home median price of $137,000. It marks the second month in a row that the statewide existing-home median price has increased over the previous month's median."

MP: Assuming the median home price in Florida is not too different from the mean home price, the total housing sales volume in the state increased from about $1.84 billion in April 2009 to about $2.35 billion in April 2010, for almost a 28% increase. If we measured housing market activity like we measured vehicle sales - in unit sales, without regard to price - we would conclude that the Florida housing market is booming, with 20 consecutive monthly increases compared to the same month in the previous year, and a whopping 27% increase from April of last year. And if we measured housing activity like we measure retail sales (total sales volume), we would also conclude that the Florida housing market is doing quite well, with something like a 28% increase in sales volume (assuming the median home price is an accurate estimate of the mean home price) in April compared to last year.

April Trucking Gains 9.4% vs. 2009, Largest Monthly Increase Since January 2005, 5th Consecutive Gain

Restaurant Performance Index Above 100 for Two Consecutive Months, First Time Since Late 2007

MP: The Restaurant Performance in April (100.4), like in March (100.5), reached the highest level since the fall of 2007, and stayed above 100 for two consecutive months for the first time since the recession started in December 2007.

Sunday, May 30, 2010

Good Question, Captain

HT: Captain Capitalism

Ultra-Deepwater Drilling and Normal Accidents

"Gulf of Mexico (GOM) oil production began from shallow water fields (water depth of under 1,000 feet) but shallow water production began to fall in 1998. Steadily increasing volumes from deepwater fields (water depths between 1,000 and 4,999 feet) offset these declines until 2004, after which deepwater production also began to decline (see chart above).

But, ultra-deepwater production (water depths more than 5,000 feet) has risen dramatically since 2004 (and more than tripled since 2005), stemming the overall decline in GOM production. A trio of high-profile ultra-deepwater discoveries - Atlantis, Thunder Horse, and Great White (part of the Perdido development) - has recently started producing. Several more are in various stages of development."

HT: Paul Kedrosky, who argues that "part of what we're seeing here is the inevitable "normal accidents" from changing technology as we transition from one extraction depth regime to another."

Markets in Everything: Chocolate Bonds

Should We End the 30-Year Fixed-Rate Mortgage?

The reason the 30-year fixed-rate mortgage has to be a creation of government intervention, and not the market, is that it is a one-sided loan arrangement that bestows huge benefits on the borrower, but with almost no compensating benefits for the lender/bank/thrift, i.e. it's "pro-borrower and anti-lender."

As Arnold points out, there is an extremely valuable pre-payment option on a 30-year fixed-rate mortgage that favors the borrower, who can re-finance the mortgage whenever it is to his/her advantage over the 30 years, i.e. when rates fall enough to justify the refinancing costs. Lenders have no such option to renegotiate the rate when it's to their advantage - when interest rates rise. Or to be more accurate, the pre-payment option favors the borrower when it is under-priced, which is the case in the U.S., likely as a result of government influence.

Looking again to Canada, refinancing mortgages is allowed, but there are very stiff prepayment penalties equivalent to about three months of mortgage interest (about $1,500 for every $100,000 mortgage amount), which discourages the kind of refinancing that frequently takes place in the United States and contributed to our real estate bubble and financial crisis. In other words, the pre-payment option under the Canadian system is probably much closer to a market-driven price than in the U.S.

The chart above shows the potential danger to banks of 30-year fixed-rate mortgages, and illustrates how they contributed to the S&L crisis. Because S&'L's were "borrowing short and lending long," or financing 30-year fixed-rate mortgages with short-term deposits at interest rates approximated by the 1-year T-bill rate, S&Ls were "upside down" by the early 1980s. They were paying more on short-term deposits (e.g. 10-15%) than they were earning on their 30-year fixed-rate loans (e.g. 4-8%).

Simply put, 30-year fixed-rate mortgages were a major factor in 3,000 bank failures during the S&L crisis, and this helps support Arnold's position that they have to be an artifact of government intervention because banks wouldn't willingly expose themselves to such a huge level of interest rate risk with 30-year fixed-rate mortgages with under-priced pre-payment options. All it took was a period of rising interest rates in the 1970s and 1980s to force thousands of thrifts into insolvency, largely because their assets were so heavily concentrated in 30-year fixed-rate mortgages.

Q1: Now that 30-year mortgage rates are below 5% and close to historical low levels, are we in danger of setting up another S&L-type crisis sometime over the next several decades? It wouldn't take much of an increase in inflation and short-term interest rates before many banks/thrifts could see their interest margins squeezed, and short-term rates could conceivably even rise above 5% sometime in the next 30 years, which could put the banks "upside down" again and lead to failures.

Q2: Shouldn't financial reform include putting an end to the pro-borrower, anti-lender 30-year fixed-rates mortgages in the U.S.?

Saturday, May 29, 2010

Teranet HPI for March 2010

| ||||||||||||||||||||||||||||||||||||||||||||||||||

Toronto prices were flat in March. Prices were up 0.1% in Ottawa, 0.6% in Montreal and Vancouver and 1.4% in Halifax. The broad slowing of monthly gains is consistent with a general loosening of resale-market conditions across the country. For some months now, homes have been coming on the market faster than they have been selling. Of the six metropolitan markets surveyed, Calgary remains the only one that has yet to top its pre-recession high. Its prices are down 10.3% from their peak of August 2007. Teranet – National Bank House Price Index™

The historical data of the Teranet – National Bank House Price Index™ is available at www.housepriceindex.ca.

The Teranet–National Bank House Price Index™ is estimated by tracking observed or registered home prices over time using data collected from public land registries. All dwellings that have been sold at least twice are considered in the calculation of the index. This is known as the repeat sales method; a complete description of the method is given at www.housepriceindex.ca

Teranet - National Bank House Price Index™ thanks the author for their special collaboration on this report. 1 Value of Dwelling for the Owner-occupied Non-farm, Non-reserve Private Dwellings of Canada. |

The New Age of Natural Gas: New Record High Production in March for the World's #1 Producer

As I have reported previously, the U.S. is now the world's largest producer of natural gas, having surpassed Russia's production last year to become the new "Saudi Arabia of natural gas." It's all because of a breakthrough in drilling technology, involving the use of three-dimensional seismic imaging and hydraulic fracturing of shale rock, so that huge amounts of natural gas are being produced in New York, Pennsylvania, Texas, Louisiana and other states. In 2000, shale gas accounted for only about 1% of our natural gas supply, but now about 20% of gas comes from advanced shale drilling, and that breakthrough is responsible for boosting gas production to record high levels.

The abundance of natural gas in the U.S. was completely unexpected as recently as seven years ago when Alan Greenspan in 2003 warned that shortages of natural gas could hurt the U.S. economy. We're now in a new age of natural gas because of advanced technologies, and it's going to be a real game-changer.

Friday, May 28, 2010

Solar Power: Projections Fall Short

By 2007, solar prices were actually about $3.66 per watt (about six times higher than predicted), and were predicted in this 2008 article to fall to $2.14 per watt in 2010. And we still don't have any of those giant solar-cell systems yet.

HT: Mike Salmon

Double-Digit Increases for Rail Traffic Continue

1. U.S. railroads originated 288,114 carloads during the week ended May 22, an increase of 10.6% from the comparable week in 2009 (down 12.4% from 2008).

2. Intermodal traffic was up 12.7 % from last year (down 7.9% from 2008).

3. Container volume increased 14.4 % (down 0.7% from 2008) and trailer volume rose 3.9% (down 34.4% from 2008).

4. Carload volume on Eastern railroads was up 13.6% from last year (down 17.9% from 2008).

5. In the West, carload volume was up 8.6% from last year (down 8.1% from 2008).

6. Fifteen of 19 carload commodity groups were up from last year, led by a 100% jump in metallic ores, a 79.7% gain in metals, 59.7% increase in coke, and then motor vehicles and equipment (46.8%), waste and scrap materials (32.4%), grain (22.8%), crushed stone, sand and gravel (22%), lumber and wood products (16.7%), nonmetallic minerals (15%), stone, clay and glass products (11.2%), and primary forest products, 10.3 percent.

April Las Vegas Home Sales At 4-Year High; Foreclosure Sales Lowest in More Than Two Years

1. A total of 4,462 new and resale houses sold in the Las Vegas metro area last month, down 8.5% from March but up 0.2% from a year earlier. A decline in sales between March and April is not unusual, with the decrease averaging 4.3%.

2. April’s home sales were the highest for that month since April 2006, when 6,663 homes sold, but it was 4.2% below the average April sales tally back to 1994.

3. April marked the 20th in a row in which sales have risen on a year-over-year basis, although last month’s increase was the smallest yet.

4. Foreclosure resales fell to 51.9% of resales in April, down from 53.5% in March and down from a record-high 73.7% in April 2009. Foreclosure resales have declined each month since the year-ago peak.

5. April's foreclosures of 51.9% were the lowest in more than two years, going back to March 2008.

May Consumer Confidence Up More Than Expected

April Phoenix Home Sales At 4-Year High

1. A total of 9,972 new and resale houses and condos sold in the Phoenix metropolitan area in April, up 3.6% from March before and up 10.7% from a year earlier. April’s total sales were the highest for that month since April 2006, when 12,669 homes sold.

2. The region’s overall median sale price rose above the year-ago level for the second consecutive month, reflecting widening price stability and fewer foreclosures and other properties selling below $100,000. Buyers paid a median $135,889 last month for all new and resale houses and condos in the Phoenix metro area, up 0.7% from March and up 8.7% from $125,000 a year ago.

3. One of the most noticeable changes in the mix of sales this year versus last year is the decline in foreclosure resales: Last month they represented 50.5% of the resale market, compared with 64.9% a year earlier. The peak for foreclosure resales was 66.2% in March 2009.

MP: Phoenix home sales for April are at a four-year high, median home prices are 8.7% above a year ago, and foreclosure sales are declining, all signs of a healing and recovering real estate market.

Why Are We Drilling @ 5,000 Ft. in the First Place?

Here's an excellent question from Charles Krauthammer:

"Why are we drilling in 5,000 feet of water in the first place?

Many reasons, but this one goes unmentioned: Environmental chic has driven us out there. As production from the shallower Gulf of Mexico wells declines, we go deep (1,000 feet and more) and ultra deep (5,000 feet and more), in part because environmentalists have succeeded in rendering the Pacific and nearly all the Atlantic coast off-limits to oil production (see map above, source).

And of course, in the safest of all places, on land, we've had a 30-year ban on drilling in the Arctic National Wildlife Refuge. So we go deep, ultradeep — to such a technological frontier that no precedent exists for the April 20 blowout in the Gulf of Mexico."

Mortgage Rates, Gas Prices Falling

According to data released yesterday by Freddie Mac, 30-year mortgage rates fell to 4.78% this week, which is close to an all-time historical low. The 4.78% rate this week matches several previous weeks last April and December of 4.78%, and is just slightly above the all-time low of 4.71% in the first week of December 2009 (see chart above, data here).

Gas prices (national average) have dropped over the last month, except for a small increase yesterday. Compared to $2.94 per gallon earlier in May, average gas prices at the pump have fallen about 17 cents to $2.77, which is about a 6% decrease (data here).

Thursday, May 27, 2010

CO2 Emissions Fall to 14-Year Low in 2009

Amazingly, the U.S. generated fewer energy-related CO2 emissions in 2009 than in 1996, even though we produced almost 38 percent more output last year, our population has increased by almost 38 million, and our traffic volume was 22 percent higher last year than in 1996.

The EIA estimates that only about one-third of the drop in CO2 emissions in 2009 was because of the economic slowdown and the reduction in real output, and the large majority of the decline resulted from the increasing energy efficiency of the economy and the ongoing reduction in the carbon intensity of our energy usage. Therefore, even without a recession in the first half of the year, there would have been almost a five percent reduction in CO2 emissions in 2009, which still would have been one of the largest annual declines on record.

Our expanding output of domestic natural gas from shale rock, with its 45 percent lower carbon content than coal, has played a major role in reducing the carbon intensity of our overall energy supply, and helped bring down emissions last year to a 14-year low. Now that the U.S. has overtaken Russia as the world’s largest natural gas producer and our domestic production keeps setting new record highs, the significant improvements in carbon intensity and reduced emissions from using more natural gas should continue into the future.

We’ve heard a lot of negative energy-related news lately including stories about the oil spill and environmental damage in the Gulf, and the coal mining deaths in April, but there has also been some extremely positive and environmentally-friendly data released recently by the EIA about U.S. energy usage and emissions. The positive energy statistics reported in May include new information showing that: a) the overall energy efficiency of the U.S. economy reached an all-time record high in 2009, b) there was less total energy consumed in the U.S. last year than in any year since 1996, and c) energy-related CO2 emissions fell by the largest amount last year in EIA history to the lowest level since 1995.

Cross-posted at The Enterprise Blog.

Post-Recession Pattern of Jobless Claims

For example, notice the pattern of jobless claims (4-week moving average) in the graphs below following the 1990-1991 recession and the 2001 recession. Both post-recession periods expereienced sharp declines in the early stages of recovery, followed by long periods of flattening and even some periods of upticks:

Tiffany Worldwide Sales Rise 22% in Q1

Highlights include:

- Sales in the Americas increased 22% to $315.3 million.

- Internet and catalog sales in the Americas rose 23%.

- In Asia-Pacific, sales increased 50% to $122.3 million.

- Sales in Europe rose 25% to $68.6 million.

- In Japan, sales declined 2% to $115.0 million.

Wednesday, May 26, 2010

Worker Shortage in Washington with a Jobless Rate > 9%? Orchard Brings 1,000 Workers from Jamaica?

"There was a moment when they first started calling this the "Great Recession," in 2008, that Steve Appel thought this might be the time. Americans might come back to working on the farm.

"It's just common sense, with the depression and high unemployment and what not, that there ought to be local folks looking to come take some of these jobs," says Appel, 58, a wheat farmer in the Palouse in Eastern Washington.

Nope. It hasn't happened. Farm jobs are going unfilled to such a degree that now a huge fruit orchard in Okanogan County, desperate for someone to pick cherries and apples this summer, has turned to flying in hundreds of workers from ... Jamaica. That's right. From a Caribbean island more than 3,000 miles away. In all, this one farm has applied to bring in more than a thousand temporary foreign workers."

Read more here.

Update: Thanks to Ironman for this link, showing that Washington has the second most generous unemployment benefits in the country of $586 per week as of May 3 (behind Massachusetts, which pays $628 per week or more than $31,000 per year) or more than $28,000 per year working 0 hours per week. Farm workers would "only" make about $24,380 per year picking apples, so it wouldn't make sense to work, and that could explain the "worker shortage" and why the orchard needs to hire 1,000 workers from Jamaica.

Question: How much lower than the current 9.9% would the jobless rate in the U.S. be today without the 99-weeks of unemployment benefits that can be as generous as $31,000 per year in some states? There is at least some evidence of "worker shortages" in Washington and Michigan, despite the "worst economic crisis since the Great Depression."

Rasmussen: Obama Approval at All-Time Low of -22

Sign of the Times

Source.

Orders for Durable Goods Reach 19-Mo. High

Add this to the growing list of V-shaped signs of an economic recovery gaining momentum, especially in the U.S. manufacturing sector, which added 44,000 new jobs in April - the largest single monthly gain in factory jobs since August 1998.

FedEx Restores Flight Hrs. to Pre-Recession Levels

Markets in Everything: Confiscated Wildlife Items

Pictured above is a pair of cobra sandals, available from the U.S. Fish and Wildlife Service's online auction of confiscated wildlife items that have been seized at U.S. ports for violating laws regulating international trade in wildlife.

Tuesday, May 25, 2010

April Real Estate Data for Michigan = Recovery?

Michigan home sales Year to Date (YTD) through April 2010 vs. 2009: +7.40%

Michigan avg. sales price in April 2010 vs. 2009: +14.87%

Michigan averages sales price YTD 2010 vs. 2009: +12.16%

Bottom Line: With unit home sales in Michigan increasing this year for both: a) the month of April vs. last year, and b) YTD through April this year vs. last year, and with average home prices increasing by double-digits for: c) the month of April (14.87%), and d) YTD through April (12.16%), I think there's a case for a real estate recovery going on in Michigan this year.

Markets in Everything: $97 iPhones at Wal-Mart

The reduced price comes less than two weeks before Apple is expected to unveil the next-generation model, which often leads to a dramatic drop in sales of older iPhones."

Case-Shiller vs. Actual Sales Data for Detroit Metro

According to the Michigan Association of Realtors, we have the following March-March increases in average home prices for the Detroit metro areas included in the Case-Shiller Detroit metro area (and year-to-date January-March data in parentheses, since the Case-Shiller index uses a 3-month moving average), along with the entire state:

Detroit: +43.99% (+29.33%)

Lapeer: +17.38% (+6.29%)

Livingston: +7.87% (-2.28%)

Macomb: + 11.89% (+7.08%)

Oakland: + 21.51% (+23.14)

Entire State of Michigan: +9.86% (+10.76%)

Here's a description of the Case-Shiller methodology, which says that:

"The S&P/Case-Shiller Home Price Indices are designed to be a reliable and consistent benchmark of housing prices in the United States. Their purpose is to measure the average change in home prices in a particular geographic market. The monthly S&P/Case-Shiller Home Price Indices use the “repeat sales method” of index calculation – an approach that is widely recognized as the premier methodology for indexing housing prices – which uses data on properties that have sold at least twice, in order to capture the true appreciated value of each specific sales unit.

To calculate the indices, data are collected on transactions of all residential properties during the months in question. The main variable used for index calculation is the price change between two arms-length sales of the same single-family home."

In other words, it looks like the Case-Shiller index controls for quality of housing, and tries to compare the same exact house sold in two different periods. While that might be theoretically the premier methodology, it should also be recognized that there could be significant departures between prices from the Case-Shiller indices and average price data from housing sales.

For example, all indications from the Michigan Association of Realtors are that home prices have increased in the Detroit area from a year ago, by double-digits in most cases for March, and year-to-date all areas except Livingston have experienced price increases, with double-digit increases for Detroit (+29.33%) and Oakland (+23.14%). Home prices have also increased statewide as well, both for March and for the first quarter (Jan-Mar). That's quite a different story than the -4.62% decrease in Detroit area home prices according to the Case-Shiller for March.

Comments welcome.

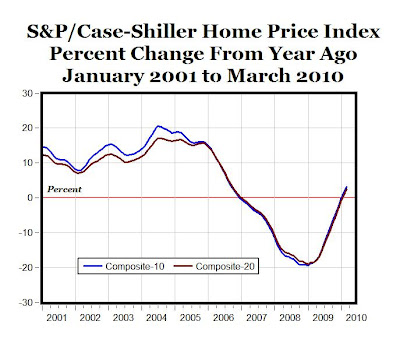

Largest Year-to-Year Gain in Case-Shiller Since '06

1. Two consecutive monthly increases in February home prices (0.71% for the seasonally-adjusted Composite-20 and 0.66% for the unadjusted index) and March (2.42% for the seasonally adjusted Composite-20 and 2.35% for the unadjusted index), following 37 consecutive monthly declines in the home price index.

2. The February and March increases were the first two back-to-back monthly gains in home prices since November and December 2006.

3. The March gain of 2.42% was the largest monthly increase in the Composite-20 index since October 2006.

Note: The chart is based on the seasonally-adjusted Case-Shiller Home Price Indexes. The unadjusted indices produce almost identical results as those listed above.